$100 Billion Wiped Off Home Depot’s Market Cap: Should You Buy Now?

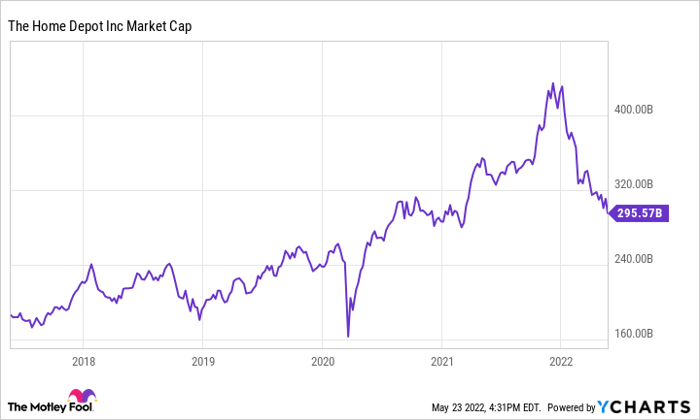

After at first crashing at the pandemic’s onset, House Depot‘s (NYSE: High definition) marketplace capitalization had almost tripled before shedding about $100 billion in 2022. The household improvement retailer was a surprise winner during the pandemic phases, exactly where enterprise closures have been prevalent. Trapped at property with constrained choices on what they could do with their time and revenue, shoppers opted to get on a lot more dwelling improvement tasks.

As a outcome, Property Depot’s revenue and gains surged. Regrettably for shareholders, the pattern is reversing, and financial reopening next widespread vaccination is slowing growth. The trader exodus has brought about additional than $100 billion to be wiped off the company’s market place cap — which might have some people questioning if they should really get Home Depot stock now. Let’s get a closer appear at that problem.

Hd marketplace cap. Information by YCharts.

Household Depot is developing EPS at a strong clip

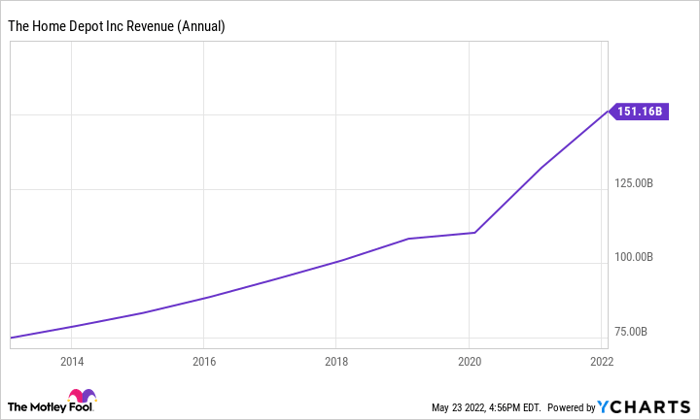

When new effectiveness has been volatile, it helps to seem at the for a longer time expression. Dwelling Depot has grown earnings in the previous decade at a compound yearly charge of 7.9%. The unparalleled instances of the pandemic caused gross sales to surge in its two most-recent fiscal several years.

But investors would be prudent to anticipate the for a longer time-expression development premiums in its place. Concentrating on the long run could assistance reduce fear in excess of the upcoming calendar year or two, when the company’s growth is very likely to be muted. In truth, management has forecast revenue advancement of just 3% in its current fiscal yr.

High definition earnings (annual). Information by YCharts.

But that is not a little something that ought to discourage traders, in particular with a business like Household Depot, which does an fantastic career of leveraging preset fees to supply profits. In the very same 10 yrs pointed out higher than, when income grew by 7.9%, the business amplified earnings for each share (EPS) at a compound annual level of 20.2%.

Its benefits highlight that not all profits advancement is equivalent. Now, many businesses are expanding remarkably quickly but are building substantial losses on the base line with no demonstrating any economies of scale.

Moreover the short-expression headwind from financial reopening, Residence Depot’s extensive-phrase prospective customers are in very good condition. Management generally states the No. 1 indicators of residence enhancement paying out are home values. When property owners see their house charges rise, they are encouraged to devote on advancement jobs. And in accordance to the Federal Reserve Financial institution of St. Louis, dwelling prices have by no means been higher.

Include in the truth that quite a few house owners locked in file-reduced desire prices at the first stages of the pandemic, which have due to the fact risen, and they are much more possible to pick out dwelling renovation instead than wanting to promote and transfer to a new dwelling.

Image resource: Getty Visuals.

The Bottom Line

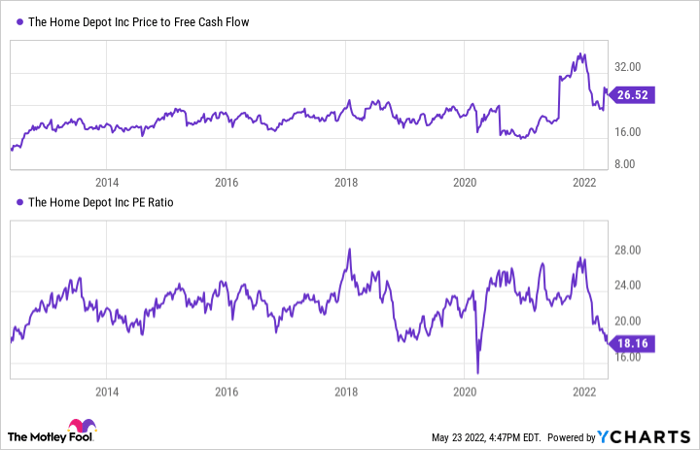

So is Residence Depot inventory pricey? If measured by the value-to-free of charge-hard cash-move ratio, Household Depot is on the expensive aspect of its historical valuation. But if you evaluate by its price-to-earnings many, the stock has scarcely at any time been cheaper in the past 10 years.

High definition selling price to absolutely free dollars movement. Knowledge by YCharts. P/E = selling price to earnings.

I like to use a blended method to encompass the two metrics, and from that viewpoint, I would argue that the shares are rather valued, neither highly-priced nor affordable.

So to solution the query posed in the headline, yes, you can acquire Household Depot inventory now. Buyers will do perfectly if they obtain outstanding companies at a fair price tag.

10 shares we like much better than Household Depot

When our award-profitable analyst crew has a inventory tip, it can pay to listen. Soon after all, the newsletter they have run for about a 10 years, Motley Idiot Stock Advisor, has tripled the market place.*

They just uncovered what they believe are the 10 best stocks for traders to purchase ideal now… and Dwelling Depot was not a person of them! That’s suitable — they believe these 10 stocks are even greater buys.

*Stock Advisor returns as of April 27, 2022

Parkev Tatevosian has no situation in any of the stocks described. The Motley Fool has positions in and recommends Home Depot. The Motley Fool has a disclosure policy.

The views and views expressed herein are the sights and views of the author and do not automatically reflect those people of Nasdaq, Inc.